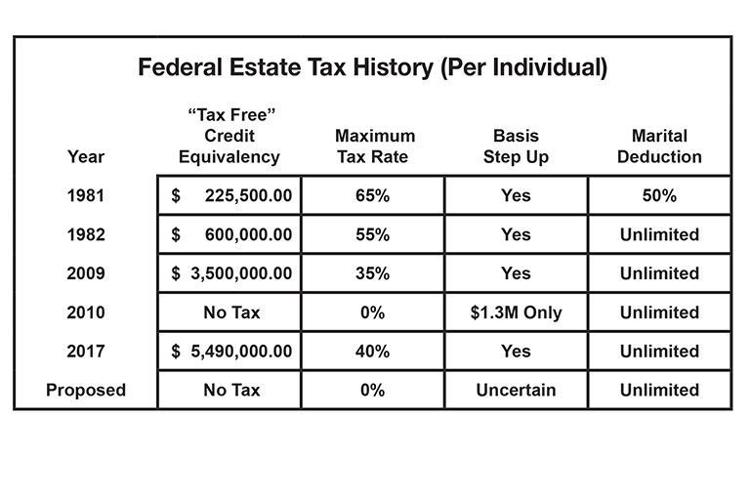

proposed federal estate tax changes

One of the proposals would reduce the estate tax exemption to anywhere between 35 and 5 million with an effective date of January 1 2022. After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes.

Federal Estate Tax Boston Financial Management

5376 known as the Build Back Better Act the Act.

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

. Estate Tax Rate Increase. Current 117 million gift and estate tax. The alert is available for download here.

The Act would drastically reduce the estate tax exemption to 35 Million per person while setting the gift tax exemption to 1 Million. The Albanese governments proposed change on franking credits if it becomes law will raise only 10 million a year. The proposed bill provides major changes to the estate and gift tax rules that could reverse parts of the Tax Cuts and Jobs Act of 2017 and significantly limit opportunities for.

The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35. The maximum estate tax rate would increase from. Another proposal would bring new rules to.

Federal Estate Tax Rate. Proposed Federal Estate Planning Changes. Under the current proposal the estate tax remains at a flat rate of 40.

Why bother given Labors proposed. This was anticipated to drop to 5 million adjusted for inflation as of. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1.

Lifetime estate and gift tax exemptions reduced and decoupled. The House Ways and Means Committee recently introduced a wide variety of potential changes to the tax code. This leads to the question.

It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion. Proposed Estate and Gift Tax Changes Under a Senate Bill introduced by US. The Committee specifically proposed rolling back the 2017.

The 2017 Tax Cuts and Jobs Act TCJA overhauled. An investor who bought Best Buy BBY in 1990 would have a gain of over 108000 to the end of 2020. Boring Kansas City Southern KSU grew about 78000 from.

Together with the transfer tax the net worth of this. The estate and gift tax exemptions. Trusts Taxation and Planning for Your Future Proposed Estate Planning.

A reduction in the federal estate tax exemption amount which is currently 11700000. Proposed Legislative Changes to Federal Estate Gift and Trust Taxation. Both Senators and Representatives have proposed increasing the tax rate of taxable estates.

Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax.

Time To Plan For Progressive Tax Changes Evercore

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Flash Alert Proposed Federal Estate Tax Law Changes The Sky May Really Be Falling

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

2020 Tax Updates Federal Estate Tax Exemption Contribution Limits

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Planning For Possible Estate And Gift Tax Changes Windes

Estate Tax Current Law 2026 Biden Tax Proposal

The Biden Agenda For Estate Plans More Costly For The Rich And Not So Rich Round Table Wealth

Senate Estate And Gift Tax Proposals Hint Possible Changes Crowe Llp

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/RWUIN5KCSMYSBRP3CBQGEBG3Y4.jpg)

Spilka Signals Willingness To Deal On Estate Tax The Boston Globe

Death Taxes And Change Are Certainties Farm Transition Agupdate Com

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

The State Of Estate Taxes The New York Times

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

Preparing For The Reduction In The Federal Estate Tax Exemption The Levin Law Firm Philip Levin Esq

How Could We Reform The Estate Tax Tax Policy Center

Proposed Taxable Estate Deduction Changes Dallas Business Income Tax Services