does florida have capital gains tax on stocks

Illinoiss tax is being phased out by exempting increasing amounts of capital stock liability. However theyll pay 15 percent on capital gains if their income is 40401 to 445850.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Above that income level the rate jumps to 20 percent.

. Youll have a capital gain of 5000. The good news is that the Texas cap on capital gains is 15. However it does have a combined rate of 25 which takes into consideration the Federal capital gains rate the 38 Surtax on capital gains and the marginal effect of Pease.

Long-term capital gains on the other hand are taxed at either 0 15 of 20. The same is true with selling a Florida home but there are some special considerations you must take into account specific to real estate sales. Texas has a 0 state capital gains tax.

This tax is triggered only when an asset is sold so you dont have to worry about capital gains taxes as long as you own the property. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10 12 22 24 32 35 or 37. You do not have to pay capital gains tax until youve sold.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. The state sales tax rate is 6 percent on all purchases except for food and medication. You only pay them on realized gains upon sale.

F Tax will be fully phased out by Jan. While Florida doesnt tax the earnings of its citizens it collects revenue from individuals using two other forms of taxation. If you later sell the home for 350000 you only pay capital.

Floridas state sales tax is 6 and with local sales tax ordinances the total sales tax can climb as high as 85. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming.

Your long-term capital gains tax bracket is based on how much your long-term gains add on top of those. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

If youre in the 22 tax bracket thats the rate that will apply to the short-term capital gain. E The rate is 015 for the first 300000 of taxable capital. Stock market stocks Asset appreciation Real estate sales Other securities.

The rate you receive will depending on your total gains earned. Any corporation that isnt treated as a pass-through entity in Florida will. Capital gains taxes are what you pay on those profits.

Individuals dont have to pay tax on investment income in Florida but for businesses the answer isnt as favorable. Federal capital gains taxes apply to. This separates them from the yearly earned income of the taxpayer.

Anyone over the age of 55 does have to pay capital gains. Alaska currently does not have a personal income tax Florida Department of Revenue. Use SmartAssets capital gains tax calculator to figure out what you owe.

More specifically capital gains are treated as income under the tax code and taxed as such Here is what the states without a capital gains income tax told me. Since the gain is considered short-term it will be taxed at your regular income tax rate. How do you calculate capital gains on sale of property.

Tax Considerations When Selling Florida Real Estate W hen you sell a stock bond or mutual fund you owe taxes on your gain - the difference between what you paid and what you sold them for. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Additionally the states property tax rate is 789 mils or 798 per 1000 in value of the property being assessed.

No personal capital gains tax. For example if you file an individual tax return and had an adjusted gross income of. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

Federal Long-Term Capital Gains Tax Rates Rate Single Married Filing Jointly Married Filing Separately Head of Household 0 0 40400 0 80800 0 40400 0. Capital gains are the profits you earn from the sale of capital assets such as stocks bonds and real estate. Determine your realized amount.

If you sell the home for that amount then you dont have to pay capital gains taxes. The states with no additional state tax on capital gains are. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

In addition you may owe state taxes. Alaska Department of Revenue. The schedule goes as follows.

Capital gains are the profits realized from the sale of capital assets such as stocks bonds and property. Long-term capital gains apply to profits on stocks held one year or more. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

The 2021 exemption is 1000. You may owe capital gains taxes if you sold stocks real estate or other investments. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

The capital gains tax is based on that profit. Florida capital gains tax isnt levied on asset profits. The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket.

In this case the tax liability will be 1100 5000 times 22. Does Florida have a capital gains tax. The tax will be fully phased out by 2024.

There is currently no Florida. Individuals pay capital gains taxes to the federal government.

Taxation In The United States Wikiwand

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How High Are Capital Gains Taxes In Your State Tax Foundation

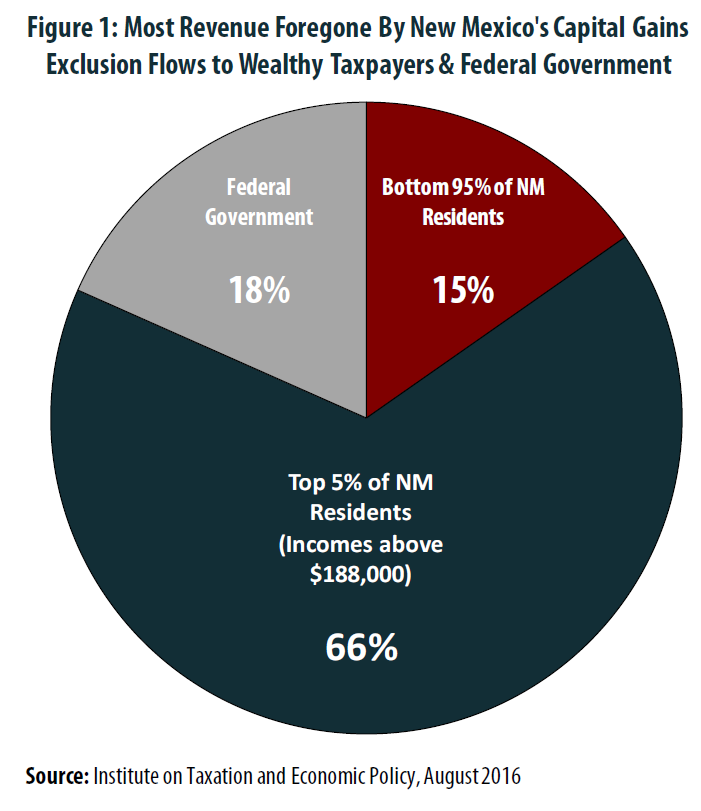

The Folly Of State Capital Gains Tax Cuts Itep

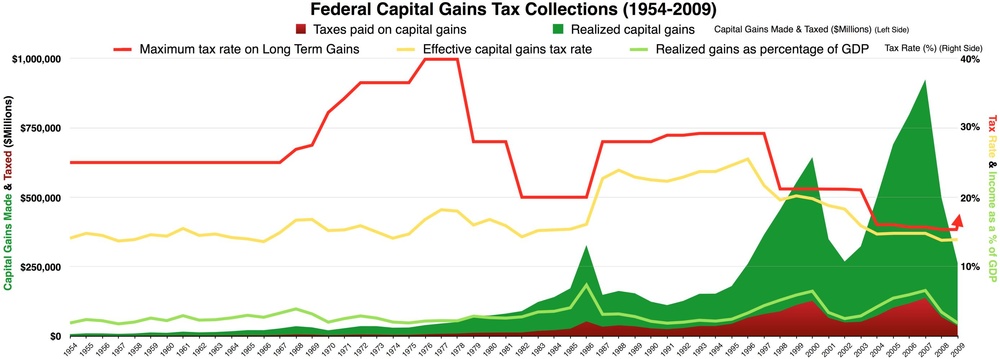

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax In Kentucky What You Need To Know

Restricted Stock Units Jane Financial

The States With The Highest Capital Gains Tax Rates The Motley Fool

When Does Capital Gains Tax Apply Taxact Blog

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Income Types Not Subject To Social Security Tax Earn More Efficiently

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation